Workers’ compensation is more than an insurance policy, but some employers only reach out to their carrier following a workplace accident. While responsive claims processing and management are core features of workers’ comp coverage, most insurance companies also provide a wide range of informational materials and safety tools that can help keep employees safe and healthy at work. These supplemental resources are incredibly useful for preventing on-the-job injuries and illnesses, especially for small businesses that employ a compact workforce. The loss of a single worker can have a significant impact on small-scale operations, so it pays to stay proactive about workplace safety and develop a meaningful relationship with your insurance carrier. But before we get into the extra benefits, it may be helpful to quickly recap how workers’ comp contributes to the long-term success of any type and size of business.

A Brief Overview of Workers’ Compensation

Workers’ comp insurance protects business owners in two meaningful ways. First, it covers the medical costs, rehabilitation expenses and some of the lost wages for employees who experience a work-related injury or illness. Secondly, it shields businesses from any civil lawsuits their workers may file following a job-related accident, as employees waive their right to take legal action in exchange for compensation benefits.

While workers’ comp is required by law in almost every state, some exemptions do exist for small businesses with fewer than five workers and for independent contractors, according to the Insurance Information Institute. Every state has different insurance guidelines, so it’s important to do a bit of research to find out if coverage is mandatory in your region. That said, workers’ comp is just as important for your employees’ well-being as it is for your business’ bottom line, as injuries and illnesses can have a lasting impact on their future employment opportunities, financial stability and mental health. The best way to protect your employees is to be proactive about workplace safety and constantly look for opportunities to improve, which is where the “extras” come in.

What Added Benefits Does Workers’ Comp Offer?

Every insurance provider is different, but all workers’ comp carriers offer some form of claims management support. Workplace injuries and illnesses should be reported as soon as an accident occurs, as this allows your claims adjuster to file a case and provide the injured worker with appropriate medical care. Insurance carriers that manage a high volume of caseloads often struggle to deliver the personalized support, which is why FFVA Mutual assigns dedicated claims adjusters to guide our policyholders through every step of the process. This added benefit helps to streamline the claims management process and ensure your workers have a clear path to recovery.

At FFVA Mutual, we are committed to supporting the health and well-being of every employee, which is why we provide no-cost safety training, online materials and customized return to work programs. Here’s how these supplemental resources can benefit your business:

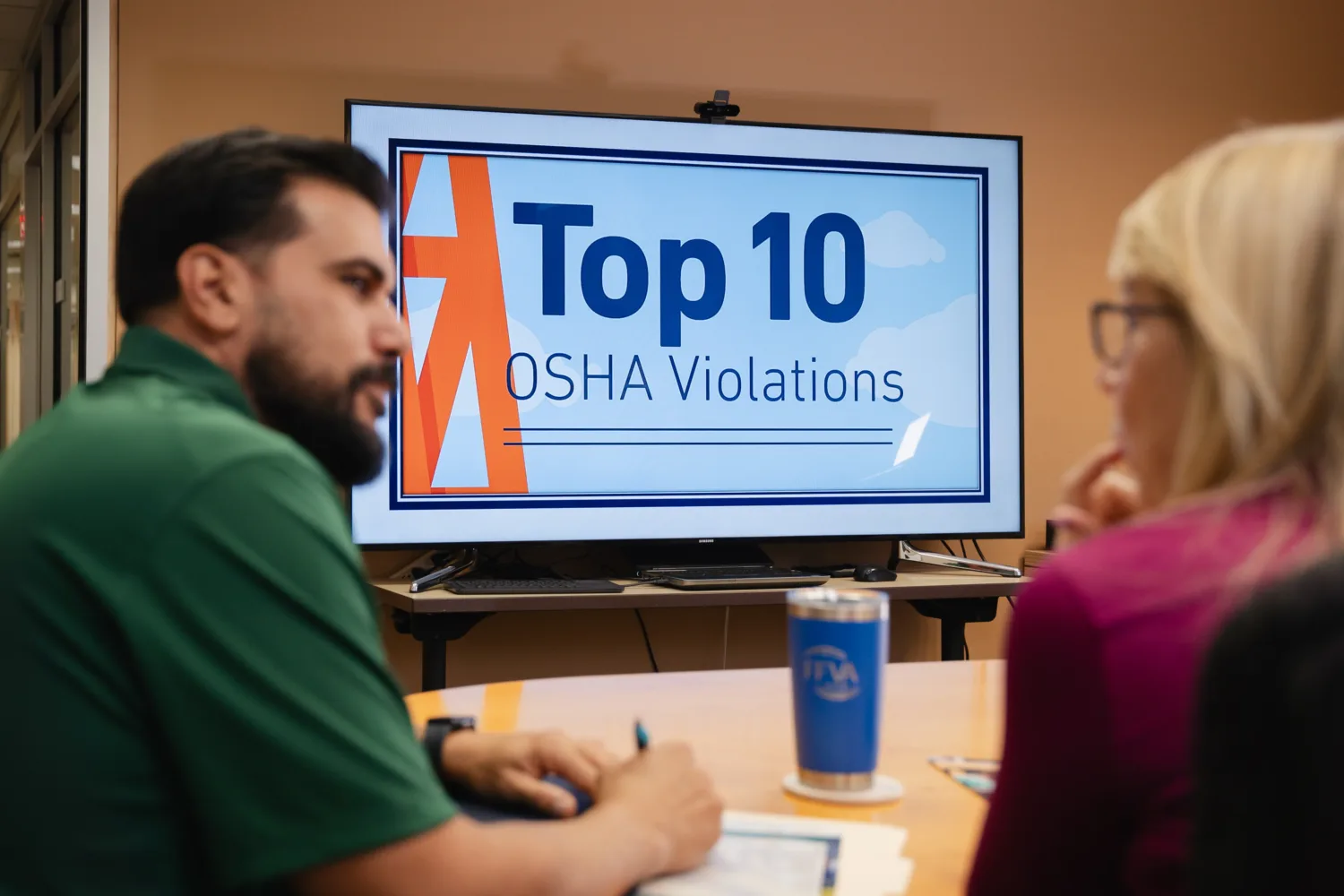

1. No-cost Safety Training

Most insurance carriers offer free online resources that touch on a variety of safety topics, from hazard awareness to health and wellness advice, but in-person instruction usually comes at a cost. FFVA Mutual provides over 30 on-site safety training courses at no extra charge, including CPR, defensive driving, and even a 10-hour OSHA course for general industries. These training events help employers and employees understand common hazards and ways to prevent workplace accidents. Additionally, our policyholders have access to our online Safety Key resources, which contain a number of customizable materials and safety tips in English and Spanish. We also supply live and on-demand webcasts and short talks on trending safety topics.

2. Workplace Safety Support

Employers interested in hands-on guidance should look for an insurance carrier that will take the time to understand their unique operational environment and safety needs. At FFVA Mutual, policyholders can contact their safety consultant directly to have important questions answered quickly, or ask a safety question online. This rapid feedback is valuable for identifying and evaluating workplace hazards, remaining compliant with existing or upcoming regulations, and developing an impactful safety program.

3. Return to Work Assistance

A comprehensive return to work program guides employers and injured workers through every step of the recovery process after a workplace injury occurs. Since every claim is different, FFVA Mutual’s designated claims adjusters develop a customized return to work approach specific to the needs of the injured worker. The goals are: to reduce expenses related to lost productivity, decrease medical, legal and disability claim costs, and help workers get back on their feet quickly and safely while providing employers with a clear rehabilitation roadmap.

To learn how you can get the most out of your workers’ comp policy, explore our safety resources or contact FFVA Mutual today!