About FFVA Mutual

Supporting workers every step of the wayfor over six decades

Workers' Comp Solutions

About Us

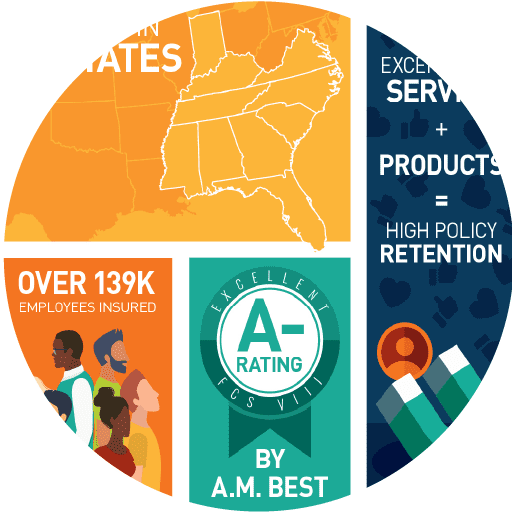

FFVA Mutual is a Florida-based regional insurance carrier specializing in workers’ compensation since 1956. Rated A- (Excellent) by A.M. Best, we insure a variety of businesses in all major industry groups and write business in 10 states (AL, FL, GA, IN, KY, MS, NC, SC, TN and VA).

Our underwriting, safety and claim solutions help businesses succeed, improve safety practices, resolve claims quickly and return injured employees to work.

A Mission Rooted in History

FFVA Mutual’s story – our history – is different from other insurance carriers because our work goes beyond providing great workers’ compensation insurance. When employers choose FFVA Mutual as their workers’ comp carrier, they not only receive industry-leading coverage but also contribute to a larger cause – the growth and distribution of fresh fruits and vegetables from farmers to tables nationwide. Learn more about our history here.

Mission and Vision

Our mission is to deliver trusted workers’ compensation solutions and personalized customer

experiences to our agency partners and policyholders through respected underwriting, expert

safety services and positive claim results.

Caring is Mutual

FFVA Mutual is proud to be a mission-driven organization. Caring is Mutual, our employee volunteer program, provides impactful opportunities throughout the year to serve local nonprofit organizations that benefit 3 Areas of Giving: Health, Community and Youth/Education.

Our Executive Team

Our team brings extensive knowledge and experience in the areas of leadership, finance, underwriting, claims, safety, loss control and marketing. Together, we’re inspired to deliver outstanding workers’ comp experiences to our agents and policyholders.

Why FFVA Mutual

Our Solutionists work alongside employers and agency partners to build proactive relationships that last. If you’re wondering “Why FFVA Mutual?”, this infographic highlights what makes us a leading workers’ comp carrier.

What Our Customers Say

Outstanding Solutions. Happy Customer Testimonials.

Read what people are saying about FFVA Mutual’s Solutionists and Services.