Employers who take time to evaluate and fine-tune their injury reporting process quickly realize that timely claim reporting helps reduce workers’ comp claim-related costs. FFVA Mutual encourages employers to report work-related injuries within 24 hours. Below are some early claim reporting advantages, along with specific workflows that create efficient and transparent processes, and boost employee morale.

Understanding the Benefits of Timely Claim Reporting

Claims reported after 14 days are more complex, take longer to close, and delay employees’ return to work. In fact, late reporting can increase claim costs up to 51%. Bottom line – early injury reporting saves employers money.

5 Ways Timely Claim Reporting Benefits Companies and Injured Workers:

- Keeps Medical Costs Down: In the most recent report provided by the Social Security Administration, workers’ comp expenses in the United States amounted to almost $62 billion. Reporting an injury to your workers’ comp insurance carrier as early as possible results in prompt, appropriate medical treatment for the injured worker – before injuries worsen and medical costs related to that claim increase.

- Quicker Claims Closure: The claims process begins as soon as the insurance carrier receives first report of injury (FROI) from the employer. When the carrier manages the medical process, they have access to top physician networks at reduced prices. This patient-centered guided treatment approach results in a positive outcome and smooth return to work transition for the injured employee, and quicker claim closure that benefits everyone.

- Reduced Legal Risk: Employees who sustain injuries at work and see little-to-no action from their employers often turn to attorneys for assistance, which results in increased employer costs. Companies can avoid this type of added expense by putting into place early claim reporting and clear communication processes that reassure employees of the company’s commitment to their health and a set plan to transition them back to work as soon as possible.

- Identifies Potential Fraud: An estimated 1-2% of workers’ comp payments are based on fraudulent claims. Businesses unknowingly lay the groundwork for these schemes by delayed insurance claims reporting, during which fraudsters can fudge details in the absence of verifiable evidence. An established workflow for accident reporting helps companies effectively assess workplace injuries and collect the kind of valuable insight needed to prevent fraud.

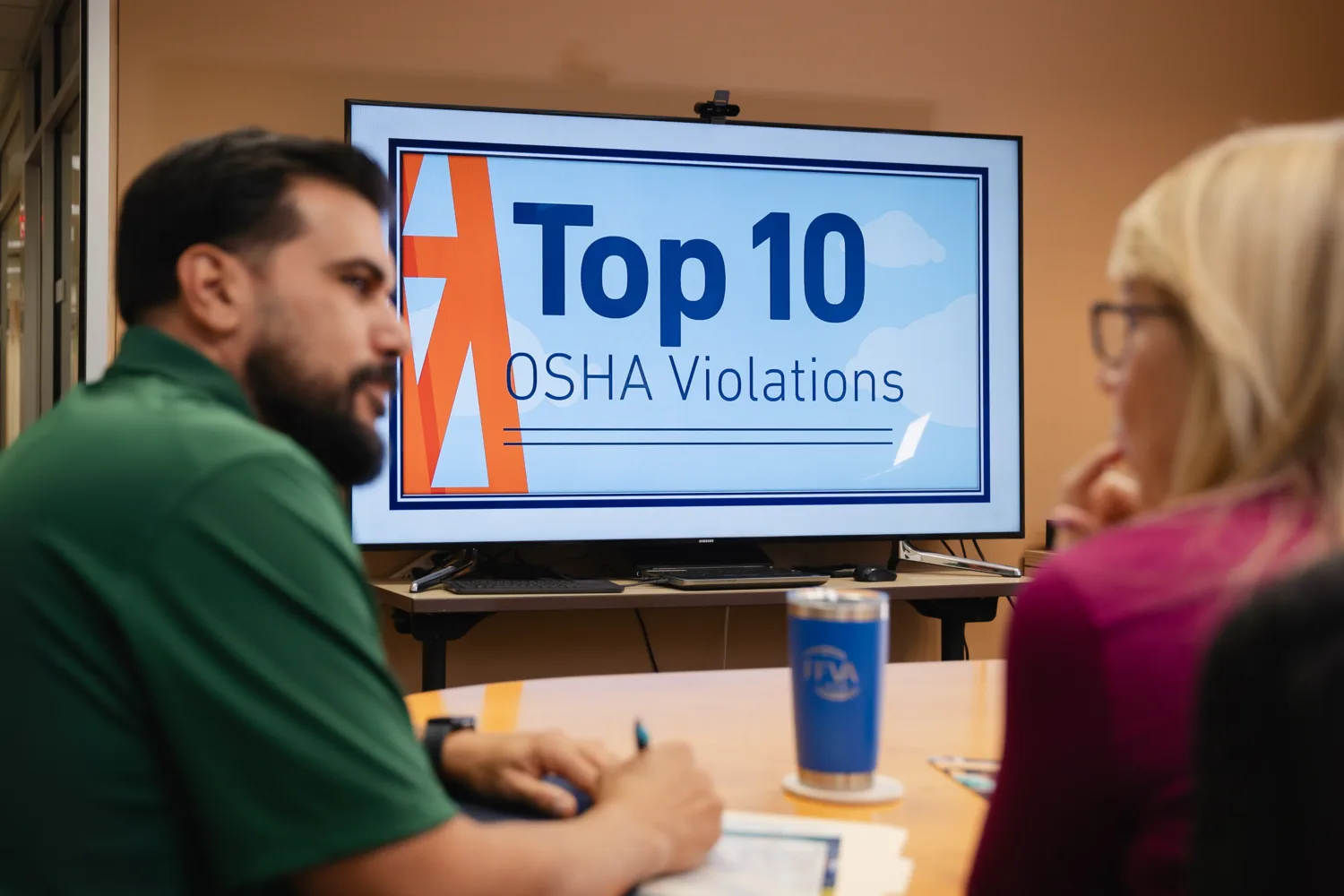

- Avoid Late Reporting Fines and Penalties: Employers must report fatalities and severe injuries to the Occupational Safety and Health Administration (OSHA). Fatalities have to be reported within 8 hours and amputations, loss of an eye or inpatient hospitalizations of one of more employees within 24 hours. In addition, most states impose fines on employers who delay reporting workplace injuries beyond a certain period. For instance, Florida charges up to $500 for late filing, and Georgia fines employers up to $1,000.

These benefits sound great, but how do businesses go about implementing a fast-tracked claim reporting process?

Safety managers and supervisors kick-start the claim process.

Claim Reporting, Investigating and Recordkeeping Workflows

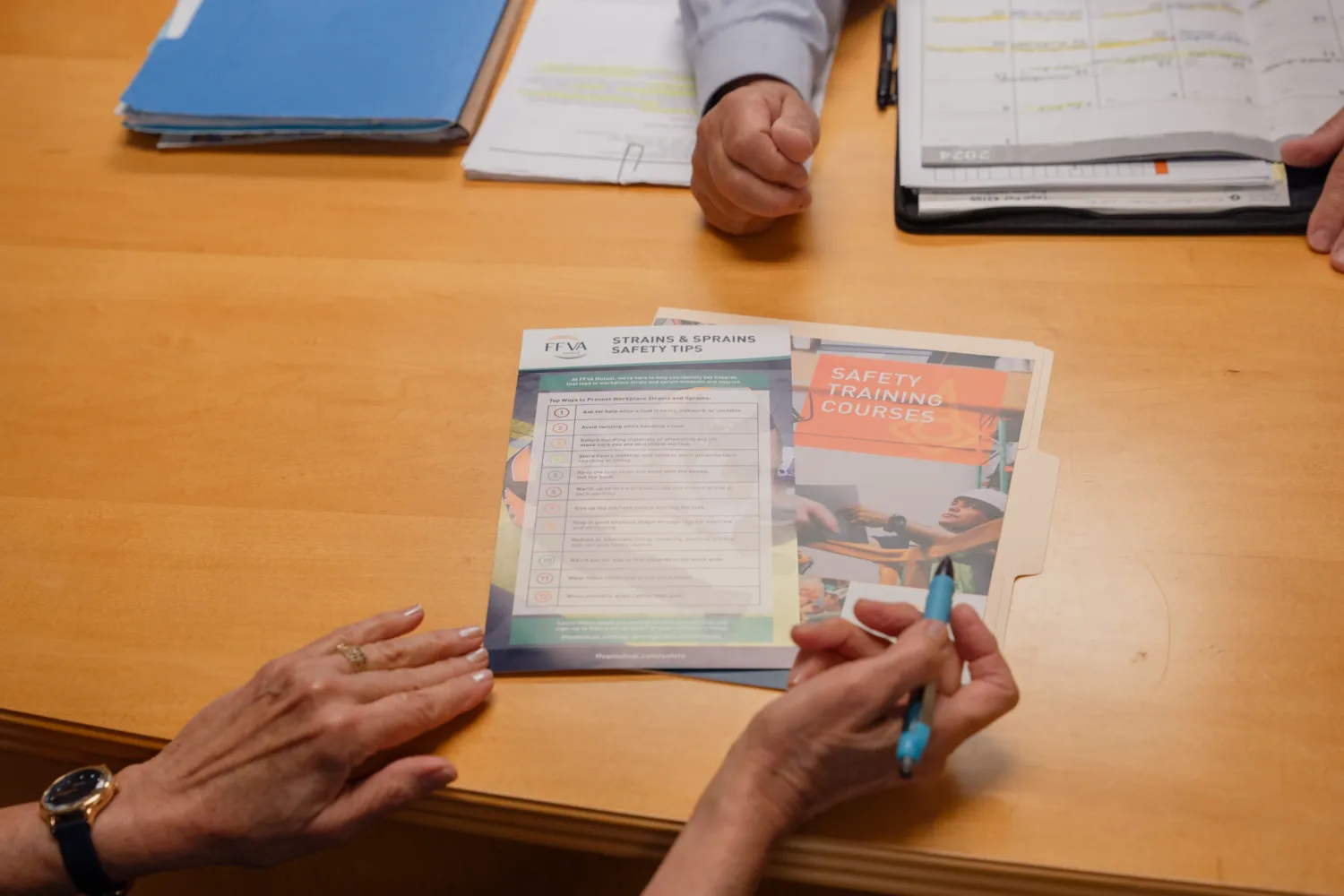

Employers looking to implement or improve their claims reporting workflow should develop accident and incident reporting programs that include these key components:

- Accelerated Claim Processes: After reporting a claim to your insurance carrier, employers should proactively communicate with their designated claims adjuster, injured worker and medical providers to return the employee back to work quickly and safely.

- Supervisor Resources: Managers are often first on the scene of an accident or incident and need tools that help them manage the reporting process. Accident investigation worksheets are the ideal solution, as they enable supervisors to gather details from both the injured workers and bystanders.

- OSHA-Compliant Recordkeeping Practices: OSHA maintains stringent injury recordkeeping and reporting requirements that businesses must meet to avoid citations and fines. For more information, watch our OSHA recordkeeping and required training documentation webcast.Is your business interested in learning more? Connect with ffvamutual.com today to learn more about our claims service advantages. While you’re at it, take a look at our online safety toolkit.