Workers’ Comp Claims Process Simplified

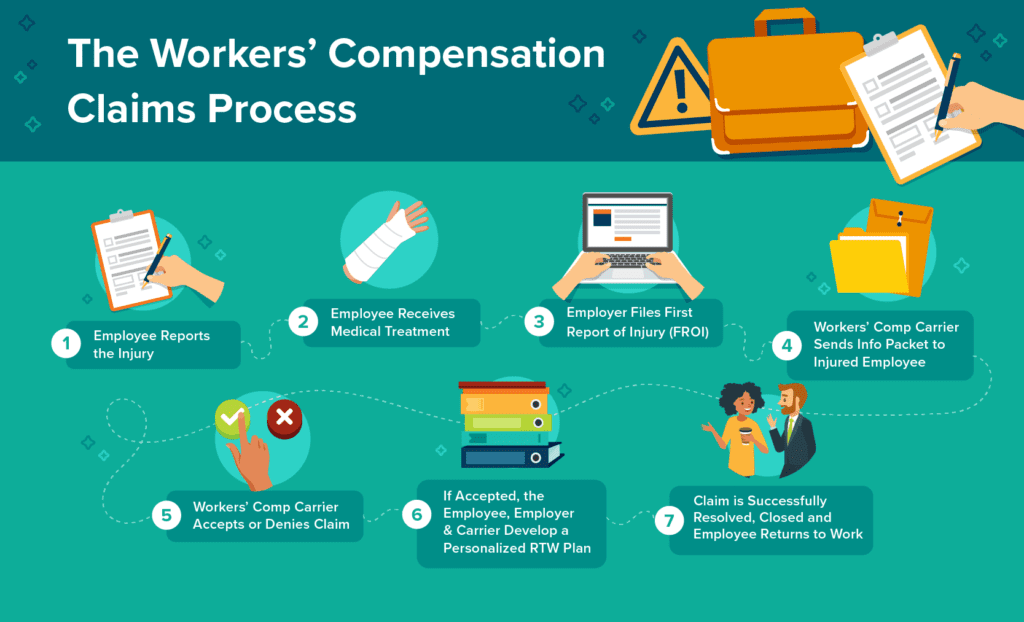

The workers’ compensation claims process is unique for every employer and injured worker, but it does not have to be a daunting task. The 7 steps outlined below clarify and simplify the workers’ comp claims process and include when employees should report an injury, who to report it to, and what happens to their claim once it’s been filed.

Every workplace injury is different, but having a trusted workers’ compensation carrier by your side is key to supporting you and your employee during the claims process to make sure they receive the care they need to successfully transition back to work.

Continue reading to get an overview of the workers’ compensation claims process from beginning to end, and learn what your responsibilities are at each step of the way.

7 Steps of the Workers’ Comp Claims Process

1. Employee Reports the Injury

This is where the claims process kicks off. When an employee gets hurt on the job, they should immediately report the injury to their employer. When reporting an injury, they should include any and all information relevant to the injury, including the day it happened, the type of injury they sustained, and how and where it occurred.

Employers should make sure employees know who they report an injury to. This person could be someone in human resources, their manager, or even a designated health or safety representative at the company.

2. Employee Receives Medical Treatment

Medical treatment depends on the severity of the injury. If the injury is not serious, then onsite first aid treatment may be enough. If this occurs, then the employer can submit a report-only claim to the carrier. However, if the injury is more serious, treatment should be sought immediately.

It’s important to note that the way medical treatment for job-related injuries works can be different depending on the state where the claim was reported. In some jurisdictions, the employer/carrier designates network medical providers that should be utilized.

Throughout the entire workers’ comp claims process, the claims adjuster will work with the injured worker to coordinate proper medical treatments and ensure the timely payment of benefits. Emphasizing positive outcomes from everyone involved helps reduce claim costs.

3. Employer Reports the Injury

Once the employee has reported their injury, it’s on the employer to report it and provide the relevant documentation to their workers’ comp carrier. Every carrier is different, but at FFVA Mutual, we ask employers to supply the following information:

- Employee information

- Employee job information

- Employer information

- Injury information

- Medical care information

- Work information

The Occupational Health and Safety Administration (OSHA) requires employers to report a fatality within 8 hours and any amputations, loss of an eye or inpatient hospitalizations within 24 hours.

4. Carrier Sends Info Packet to Employee

Once the carrier has all the information they need from the employer, they will send out an initial claim info packet to the injured employee. The info packet contains their claims adjuster contact information, information on the employee’s rights and benefits, the return to work process and other useful information that employees need to know about their claim and the workers’ comp claims process.

In addition to a copy of the accident report and other details regarding their case, this packet also includes a fraud statement containing information and possible penalties around making a false claim to be signed by the employee. The injured employee will also be asked to sign off on the release of their medical records to the carrier.

5. Carrier Accepts or Denies the Claim

Now it’s time for the carrier to make a decision. Behind the scenes, the carrier thoroughly investigates the accidents and injuries from day one.

“Once a claim is reported, the investigation process begins to determine compensability and to ensure the injured worker received appropriate benefits,” explains Vicki Hinkey, Claims Supervisor at FFVA Mutual. “It typically starts with a three-point contact: injured worker, employer and medical provider. We interview the injured worker to learn what happened, explain the workers’ compensation process and discuss entitlement to benefits. We speak to the employer and any potential witnesses regarding specifics of the injury. We also obtain and review the medical records related to the injury. After that process is completed, the adjuster reviews all the facts to determine compensability and what benefits may be due to the injured worker” said Vicki Hinkey, Claims Supervisor at FFVA Mutual.

With this information, the carrier either accepts or denies the claim. The main thing the carrier needs to determine is whether or not the injury occurred within the course and scope of employment.

During the investigation, the carrier will be on the lookout for anything that may suggest a fraudulent claim. For example, if an employee reported an injury first thing on a Monday morning that could indicate the injury actually happened over the weekend during off-hours.

6. Develop a Personalized Return to Work Plan

During this part of the workers’ comp claims process, the injured employee, employer and carrier work together to develop a personalized return-to-work (RTW) plan that fits both the employee and employer’s needs. They start by looking at the occupation and the nature of work, detailing the job duties and defining exactly what it is the employee does.

The job functions are stacked up against what the physician says the employee is capable of doing, given the state of their health and recovery. Light duty assignments are then determined to accommodate temporary restrictions.

This step is beneficial to the employer because it keeps them from having to hire additional hands or pay employees overtime if they need more time than normal to do their job. It also benefits the employee in knowing that their RTW plan is uniquely tailored to their needs and situation. Constant communication between the employer, employee and dedicated claims adjuster ensures everything moves along smoothly so the worker can return to work quickly and safely.

7. The Claim is Successfully Closed and the Employee Returns to Work

At the end of the entire workers’ compensation claims process, the employee has traditionally returned to work and is released from further care by their authorized treating physician. This normally occurs once the employee has reached maximum medical improvement.

The severity of the injury might result in permanent restrictions that may impact the employees’ ability to return to work. In those cases, other options to resolve the case could include a permanent modified position with the employer, retraining for work with other employers, or even a settlement.

The Lifecycle of a Workers’ Comp Claim, Explained

While each claim is unique, most follow the same general lifecycle. Here’s what that journey typically looks like:

- The Injury Occurs: An employee is hurt while performing job-related duties.

- Immediate Medical Attention: Depending on severity, first aid or emergency care is provided.

- Report of Injury: The employee notifies their employer with details about the incident.

- Employer’s Notification to Insurance: The employer reports the claim and provides supporting documentation.

- Seek Medical Treatment: Ongoing care is coordinated with approved providers.

- Claim Submission: The claim is formally submitted for carrier review.

- Claim Investigation: The carrier evaluates the facts, interviews parties and reviews records.

- Claim Approval or Denial: Based on the investigation, the claim is either accepted and benefits begin, or denied.

This straightforward sequence helps employers and employees understand what to expect as a claim moves forward.

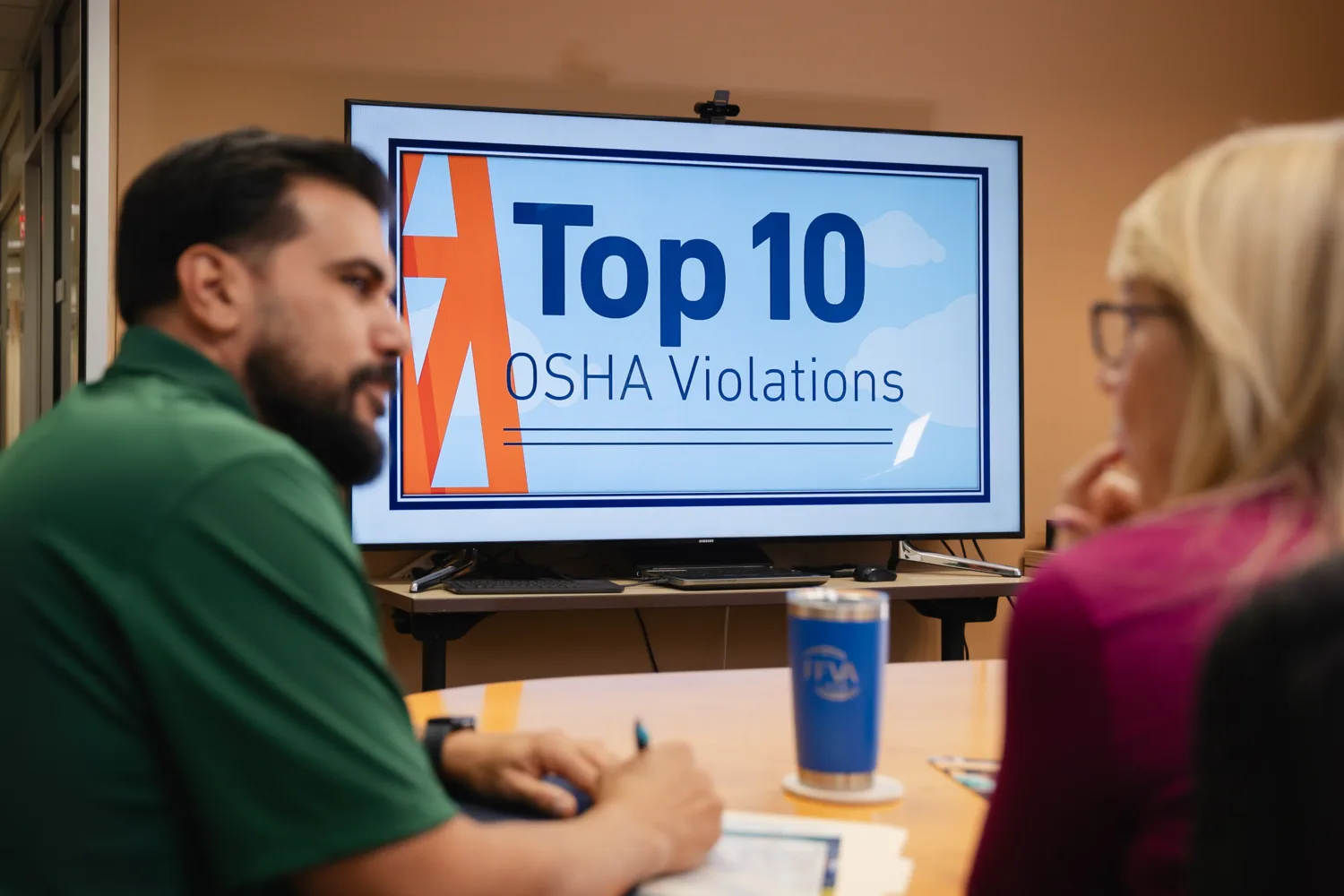

Get Support for Your Next Claim

Health and safety are the top priorities on the job, but sometimes workplace injuries happen even in the safest environments. That’s when FFVA Mutual comes in to help provide workers’ compensation insurance to protect the safety and well-being of every employee to keep your company running smoothly. To learn more about the claims solutions FFVA Mutual offers employers, visit our claims management page. We also offer no-cost safety training courses for policyholders.

If you’re an employer looking for workers’ compensation insurance coverage, find an agent located near you today for a quote and become a policyholder with FFVA Mutual!