Breaking Down Employers’ Insurance and Workers’ Comp

When it comes to running a successful business, having the right employers’ insurance policies can be just as important as hitting your sales targets.

No matter how large or small an organization may be, workplace injuries can have a major impact on daily operations and financial health. Sudden and unexpected accidents can lead to costly medical, legal and disability claims, which is why workers’ compensation coverage is such a valuable safety net.

Let’s take a close look at the world of workers’ compensation insurance and how FFVA Mutual can support the health and safety of your workforce.

Workers’ Comp vs. Employers’ Insurance: What’s the Difference?

While many employers understand the need for business insurance, the sheer number of options can be overwhelming. For one, figuring out which types of insurance solutions you should purchase often depends on your industry, company size and risk exposure. Locating a trustworthy employers’ insurance company can also be labor-intensive — policy premiums may be the same across carriers, but the quality of services tend to vary.

One of the biggest misconceptions around business insurance has to do with workers’ comp and employers’ liability coverage. Typically, these coverage areas are purchased together, but understanding where one policy ends and another begins is key.

- Workers’ compensation insurance: Workers’ comp provides coverage for medical costs, disability benefits and lost wages that stem from workplace injuries or illnesses. These policies are state-mandated for certain businesses and do not require any party to prove fault or negligence. To learn more about workers’ comp laws in your state, contact a local DFEC official.

- Employers’ liability insurance: Employers’ liability coverage, which is usually part of your workers’ comp policy, protects businesses from lawsuits involving workplace injuries or illnesses. While this type of insurance isn’t required in every state, it can help cover legal fees if an employee ever sues your company for negligence.

Under the employers’ workers comp system, businesses are required to purchase insurance that provides a range of benefits to employees who are injured or become ill as a result of their jobs. This system was designed to strike a compromise between employers and employees, ensuring each party is protected following a work-related accident. Employees get benefits irrespective of who was at fault. In return, employers are safeguarded from lawsuits by affected employees seeking monetary damages for distress and injuries.

How does Workers’ Comp work for Employers?

When an employee is injured on the job, workers’ compensation insurance provides what’s known legally as an exclusive remedy. If your business has coverage under an active policy, it won’t be held liable for job-related injuries except under certain legal circumstances. Considering the average cost of a claim is over $40,000, according to data from the National Safety Council (NSC), staying proactive can make a huge difference.

What are the Benefits of Employers’ Insurance?

Employer workers’ compensation helps businesses avoid the real cost of an employee’s medical expenses and lost wages following a workplace injury or illness. Without workers’ comp insurance, the medical costs associated with even one major claim could cause irreparable financial harm.

If your business hasn’t purchased a workers’ comp insurance policy, an injured employee may sue you in civil court. Some states have special funds to provide workers’ comp benefits for injured employees of illegally uninsured businesses. However, these funds then go after employers to reimburse the cost of those benefits. Employers who don’t have legally required insurance from a reliable employers’ compensation insurance company may also face criminal charges and steep fines.

What do Employers receive with their Workers’ Comp Policy?

The specific benefits offered through workers’ comp are usually determined by state employers’ insurance laws. These regulations also outline which diseases qualify for coverage, how claims must be filed and when employees can take legal action against their employer. Generally, workers’ compensation laws provide the following types of benefits:

- Medical coverage: Includes doctor visits, hospital care, prescription medications, physical therapy and other qualifying medical treatments.

- Disability and lost wages: Provides partial replacement of lost income when an employee is unable to work due to a job-related injury or illness. The amount and duration of these benefits depend on whether the disability is temporary or permanent, and partial or total.

- Vocational rehabilitation: Allows employees who can’t return to their prior occupation to learn new skills based on their current capabilities and medical limitations.

- Death benefits: Offers financial support to the spouse and minor children of an employee killed in a work-related accident, including funeral and burial costs.

Workers’ comp insurance for small businesses and large corporations offer the same benefits and coverage areas. Workplace accidents that lead to bodily injuries, occupational diseases (like asbestosis) and certain illnesses are all covered under your employers’ insurance policy, but that’s not all.

What Makes FFVA Mutual Different from Other Carriers?

Our policyholders rely on us for trusted workers’ compensation coverage year after year.

Every employer has different workers’ comp needs, which is why FFVA Mutual is committed to offering the personalized support your employees deserve. When we insure your business, you receive more than a policy. You become part of a family supported by professionals who are committed to providing on-site, in-person safety guidance and training programs along with responsive claims management.

FFVA Mutual policyholders and employees have access to a wide range of solutions to improve workplace safety, reduce claims and lower premium costs. These include services and resources like:

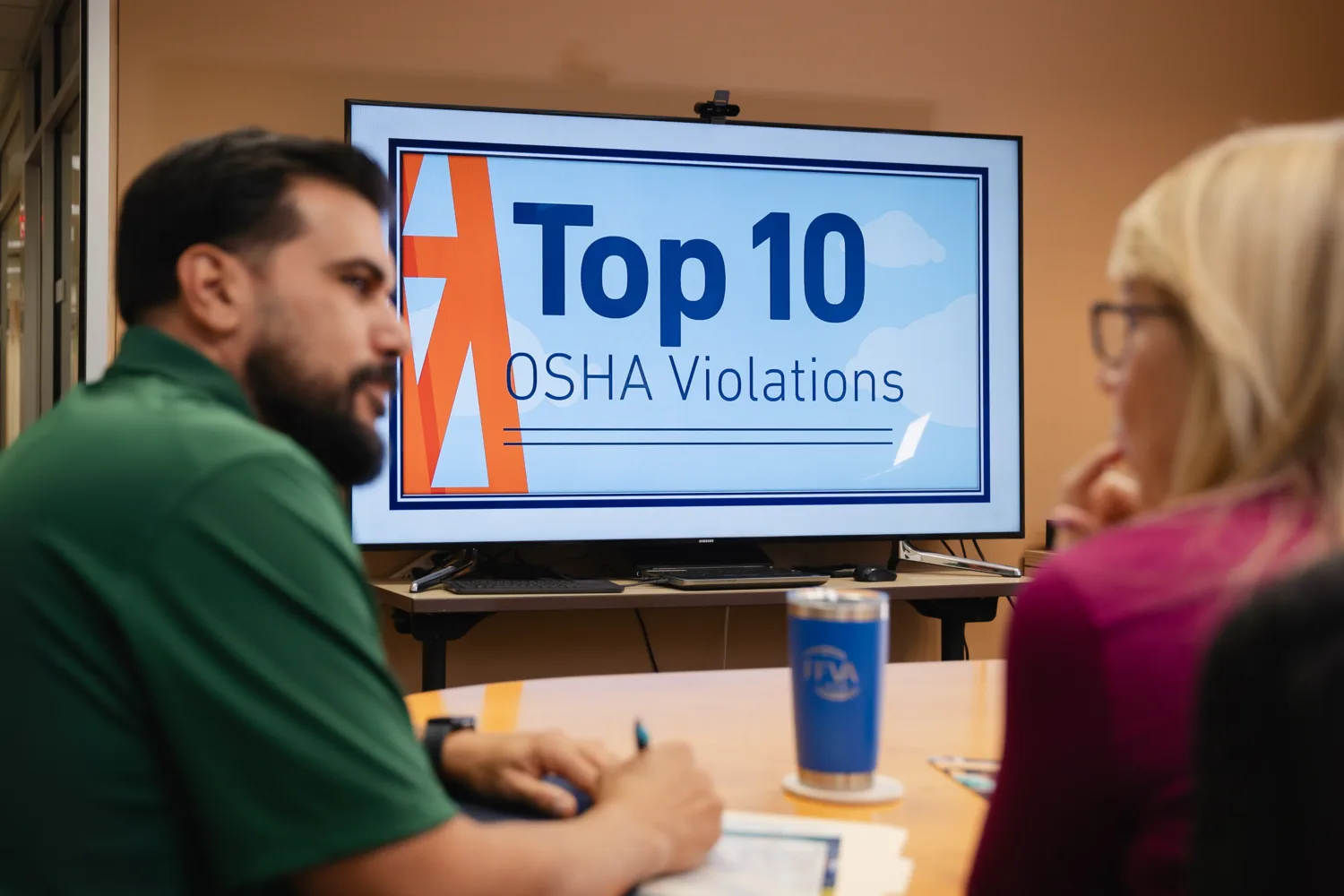

- No-cost safety training courses, both in-person and online

- A growing catalog of safety resources, including short talks, webinars and videos

- Return to Work guidance and program development support

- Hands-on account service teams with designated claims adjusters and

To learn more about FFVA Mutual’s industry-leading workers’ comp services, explore our blog or view the Top 5 Solutions we provide every employer.

Looking to become insured with us? Click here to reach out to one of our appointed agency partners located near you to get a quote today!